| MIDTERM

EXAMINATION - ITEM ANALYSIS |

| TOPIC COVERAGE |

CHAPTERS 1-4 |

| SLOs ASSESSED |

COURSE-LEVEL SLOs for

CHAPTERS #1, 2, 3, and 4 |

| DATE GIVEN |

FEBRUARY 26, 2010 |

| TYPE OF EXAM |

THEORY QUESTIONS AND

PROBLEM

SOLVING |

| NUMBER OF ITEMS (QUESTIONS) |

30

MULTIPLE CHOICE ITEMS, 13 COMPLETION-TYPE QUESTIONS (SOME QUESTIONS

REQUIRE SUPPORTING COMPUTATIONS OR THE PREPARATION OF APPROPRIATE

FINANCIAL SCHEDULES) |

| NUMBER OF STUDENTS WHO TOOK

THE EXAM |

23 OF 27; 1 STUDENT

WITHDRAWN, 3 STUDENTS ABSENT

(NOT INCLUDED IN COUNT) |

| AVERAGE GRADE = 53%

LOWEST GRADE = 26% HIGHEST GRADE = 79% |

| ITEM

# |

ANSWERED

CORRECTLY |

PERCENT |

ITEM

# |

ANSWERED

CORRECTLY |

PERCENT |

| MULTIPLE

CHOICE WITH EMBEDDED PRETEST QUESTIONS (CHAPTERS 1-4) |

COMPLETION

TYPE-QUESTIONS (CHAPTER 3) |

| 1 |

6 |

32%Tests

the student's understanding of the differences between financial

accounting and management accounting

(Chapter 1 Course-Level SLO)

|

1

|

9 |

47%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to identify the type of

transaction involved.

(Chapter 3 Course-Level SLO)

|

| 2 |

19 |

100% |

2 |

7 |

37%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to identify the type of

transaction involved.

(Chapter 3 Course-Level SLO)

|

| 3 |

19 |

100% |

3 |

9 |

47%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to journalize transactions

involving raw material and work in process inventories.

(Chapter 3 Course-Level SLO) |

| 4 |

18 |

95% |

4 |

3 |

16%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to identify the type of

transaction involved with each flow cost.

(Chapter 3 Course-Level SLO)

|

| 5 |

17 |

89% |

5 |

9 |

47%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to journalize transactions

involving work in process and finished goods inventories.

(Chapter 3 Course-Level SLO)

|

| 6 |

8 |

42%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to give the appropriate journal

entry when goods are sold.

(Chapter 3 Course-Level SLO)

|

6 |

8 |

42%Tests

the student's understanding of organizational cost flows in a

manufacturing firm and his/her ability to identify the type of costs

involved in a given transaction. (Chapter 3 Course-Level SLO) |

| 7 |

14 |

74% |

7 |

16 |

84%

|

| 8 |

7 |

37%Requires

the student to identify which organizational characteristics critically

affect the design of a cost management system.

(Chapter 2 Course-Level SLO)

|

8 |

11 |

58% |

| 9 |

18 |

95% |

9 |

13 |

68% |

| 10 |

11 |

58% |

10 |

6 |

32%Tests

the student's ability to calculate product costs

(Chapter 3 Course-Level SLO)

|

| 11 |

6 |

32%Tests

the student's understanding of the degree of conversion taking place in

companies engaged in manufacturing and service operations.

(Chapter 3 Course-Level SLO)

|

11 |

3 |

16%Tests

the student's ability to identify period costs

(Chapter 3 Course-Level SLO)

|

| 12 |

13 |

65% |

12 |

16 |

84%

|

| 13 |

14 |

73% |

13 |

18 |

95% |

| 14 |

19 |

100% |

Tests

the student's knowledge and skill in completing a properly-formatted

work sheet

(Course-Level SLO #4)

REMARKS

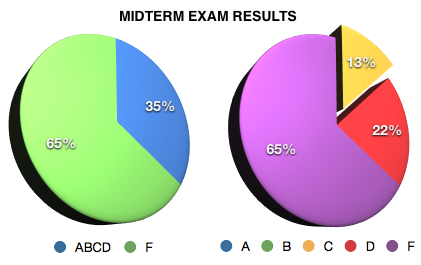

OF THE TWENTY-THREE STUDENTS who took the test, fifteen

(65%)

failed. Only three (13%) passed with grade of C, while the remaining

five

(22%) barely made it with grade of D. (See

charts below.)

While the multiple choice questions (owing to their

highly conceptual nature) have

historically been

more challenging for many students even in past semesters, completion

questions included in this test

were easy. Some students, however, seemed to have difficulty

in understanding the questions. For example,

in

the statement "Raw Materials Inventory account is debited when

_________________," instead of giving the type of transaction

required to complete this sentence, the student gave the account title to be

credited to complete the related journal entry.

|

| 15 |

15 |

79% |

| 16 |

16 |

84% |

| 17 |

13 |

68%

|

| 18 |

16 |

84%

|

| 19 |

6 |

32%Requires

the student to identify ways by which activity-based costing and

activity-based management can effectively help managers.

(Chapter 4 Course-Level SLO)

|

| 20 |

8 |

42%Tests

the student's ability to identify which factor is most likely to make

the implementation of actity-based costing/activity-based management

slow and difficult. (Chapter 4 Course-Level SLO) |

| 21 |

11 |

58% |

| 22 |

16 |

84% |

| 23 |

17 |

89% |

| 24 |

13 |

68% |

| 25 |

10 |

53% |

| 26 |

7 |

37%Tests

the student's understanding of a traditional accounting system as

opposed to an activity-based accounting system.

(Chapter 4 Course-Level SLO)

|

| 27 |

10 |

53% |

| 28 |

6 |

32%Tests

the student's knowledge as to how preliminary costs allocations are

assigned under activity based costing.

(Chapter 4 Course-Level SLO)

|

| 29 |

4 |

21%Tests

the student's ability to point out the best reason for using

activity-based costing.

(Chapter 4 Course-Level SLO)

|

| 30 |

2 |

11%Tests

the student's understanding of cost-benefit analysis as a key concept

underlying cost driver analysis.

(Chapter 4 Course-Level SLO)

|